massachusetts estate tax return due date

The due date for filing the estate tax returns is nine months from the decedents death. Occurring on or after January 1 2006 if a decedents Massachusetts gross estate exceeds 1000000 the Massachusetts filing threshold a Massachusetts estate tax return must be filed within nine months of the date of death and any tax due must be paid at that time.

Basic Tax Reporting For Decedents And Estates The Cpa Journal

This is the due date for the filing and payment of the.

. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension. Massachusetts Estate Tax Return Rev. Estate tax returns and payments are due 9 months after the date of the decedents death.

Note that it is also possible to get a six-month extension of time to file these returns although if there is. As of 2016 if the executor pays at least. The full amount of tax due for the estate tax return must generally be paid within nine months after the date of the decedents death.

If the estate is worth less than 1000000 you dont need to file a return or pay an. Only about one in twelve estate income tax returns are due on April 15. 65C 14a before amendment effective before December 31 1985 for all Massachusetts real estate included in the Massachusetts gross estate the Massachusetts.

If the estate is worth less than 1000000 you dont need to file a return or pay an. Massachusetts Estate Tax Return Rev. Up to 25 cash back Deadlines for Filing the Massachusetts Estate Tax Return.

If the executor doesnt file a required estate tax return return within nine 9 months from the date of death or within an approved period of extension he or she will have to. After December 31 2000 do not affect the computation of the Massachusetts estate tax. If youre responsible for the estate of someone who died you may need to file an estate tax return.

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines Only to be used prior to the due date of the M-706 or on a valid Extension. According to IRS data the number of processed tax returns on a year-over-year basis. Estate tax returns and payments are due 9 months after the date of the decedents death.

1018 Name of decedent Date of death mmddyyyy Social Security number 3 3 3 Street address at time of death. File a 2021 calendar year return Form M-990T and pay any tax interest and penalties due. If youre responsible for the estate of someone who died you may need to file an estate tax return.

31 rows Generally the estate tax return is due nine months after the date of death. This due date applies only if. All references to the US.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will. 416 Name of decedent Date of death mmddyyyy Social Security number 333 Street address at time of death CityTown State Zip County of. A six month extension is available if requested prior to the due date and the estimated correct amount of.

Due on or before December 15 2022. The Tax Relief Unemployment Insurance. If a return is required its due nine months after the date of death.

Massachusetts requires estate tax returns to be filed within nine months following a. Form 706 are to the form with a revi- sion date of July 1999. If your taxable estate including any taxable gifts made during your lifetime totals 1 million or more your estate must file a Massachusetts estate tax return and you may owe.

Should You Elect The Alternate Valuation Date For Estate Tax

The Affluent Investor Financial Advice To Grow And Protect Your Wealth Phil Demuth Financial Advice Financial Literacy Investors

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Massachusetts Estate And Gift Taxes Explained Wealth Management

A Guide To Estate Taxes Mass Gov

How To Avoid Estate Taxes With Trusts

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

A Guide To Estate Taxes Mass Gov

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Exemption 2021 Amount Goes Up Union Bank

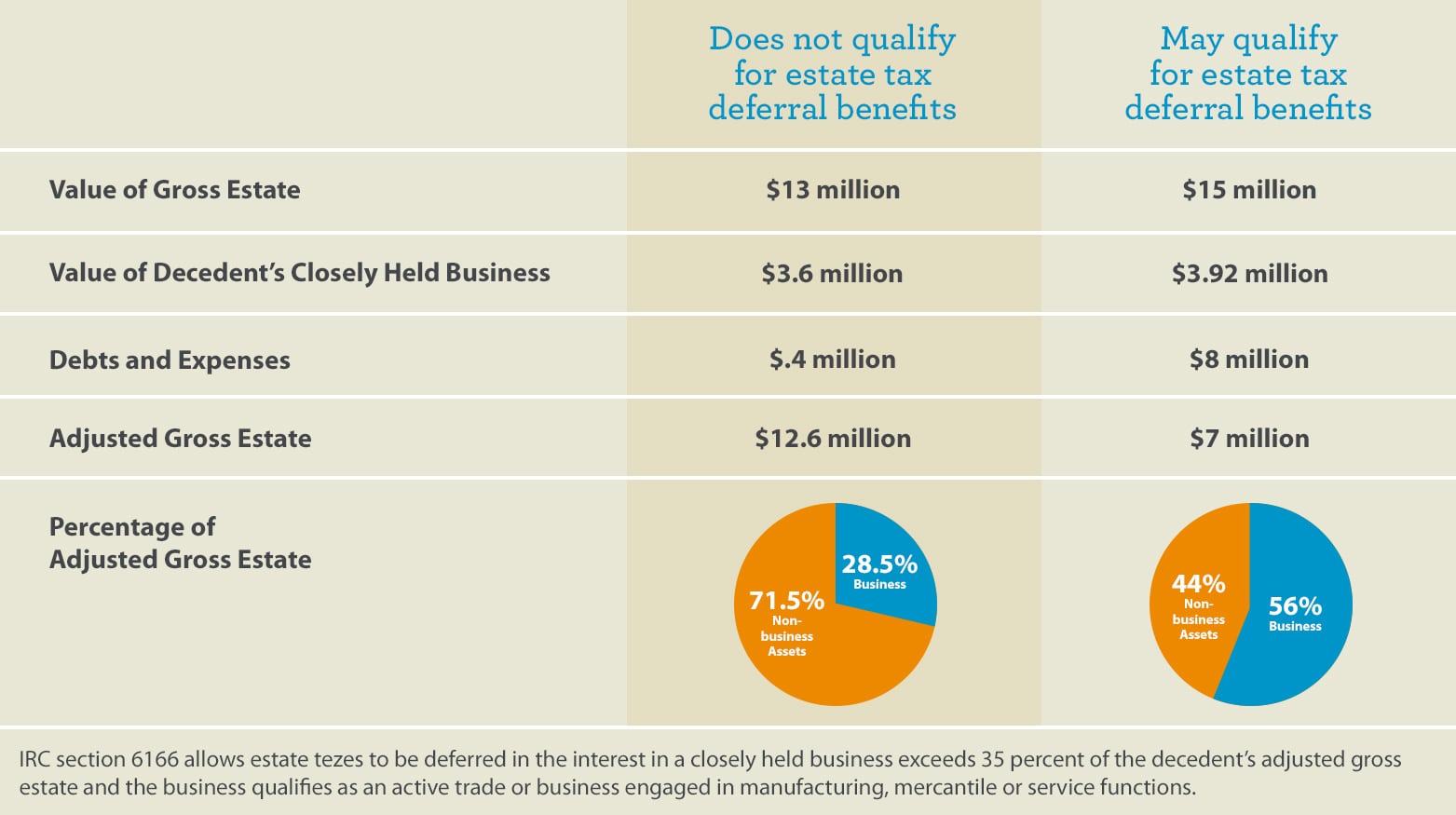

Estate Taxes On A Closely Held Business Under Irc 6166 Wells Fargo Conversations

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

How Do State Estate And Inheritance Taxes Work Tax Policy Center

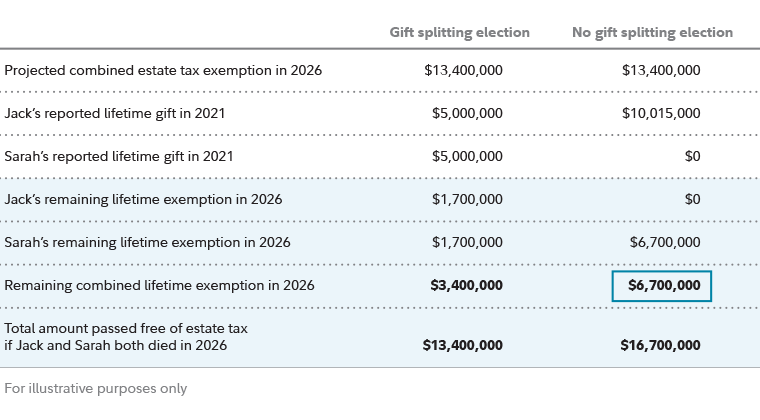

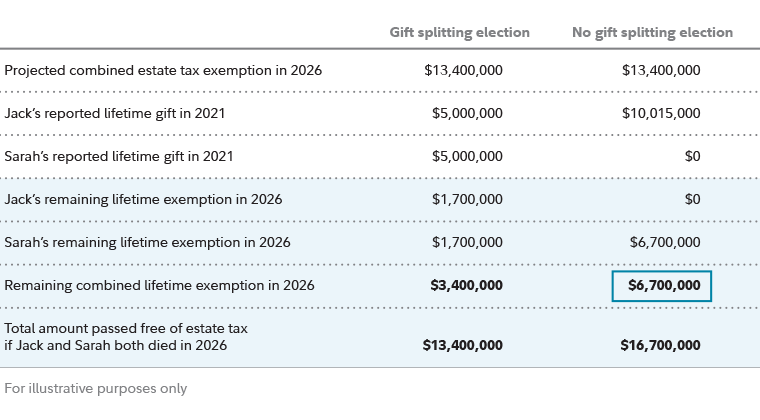

Estate Planning Strategies For Gift Splitting Fidelity

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel