closed end loan vs credit card

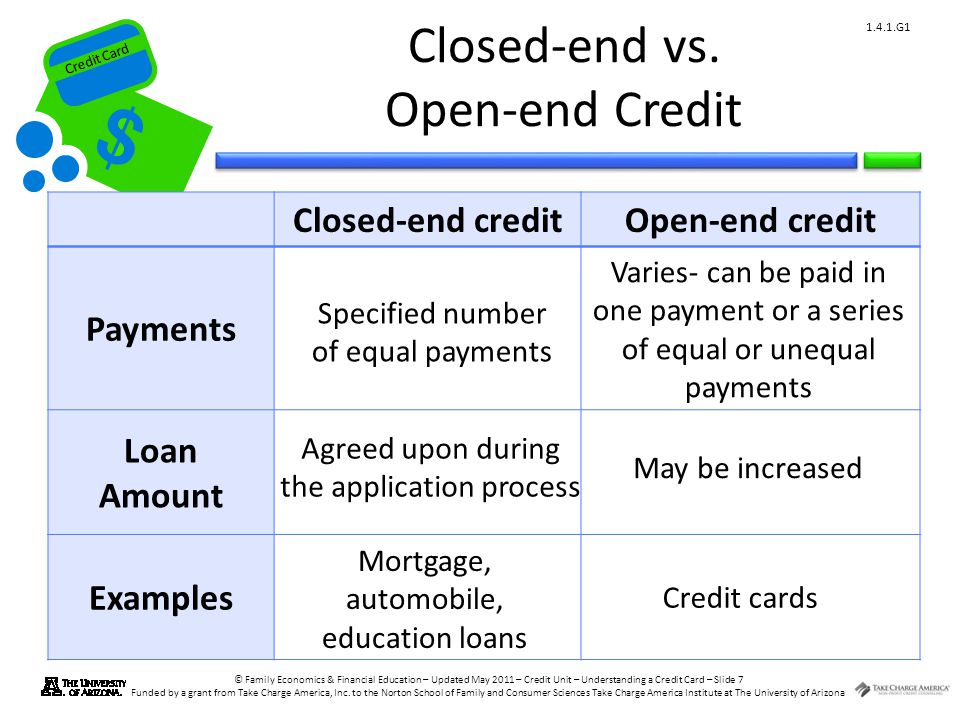

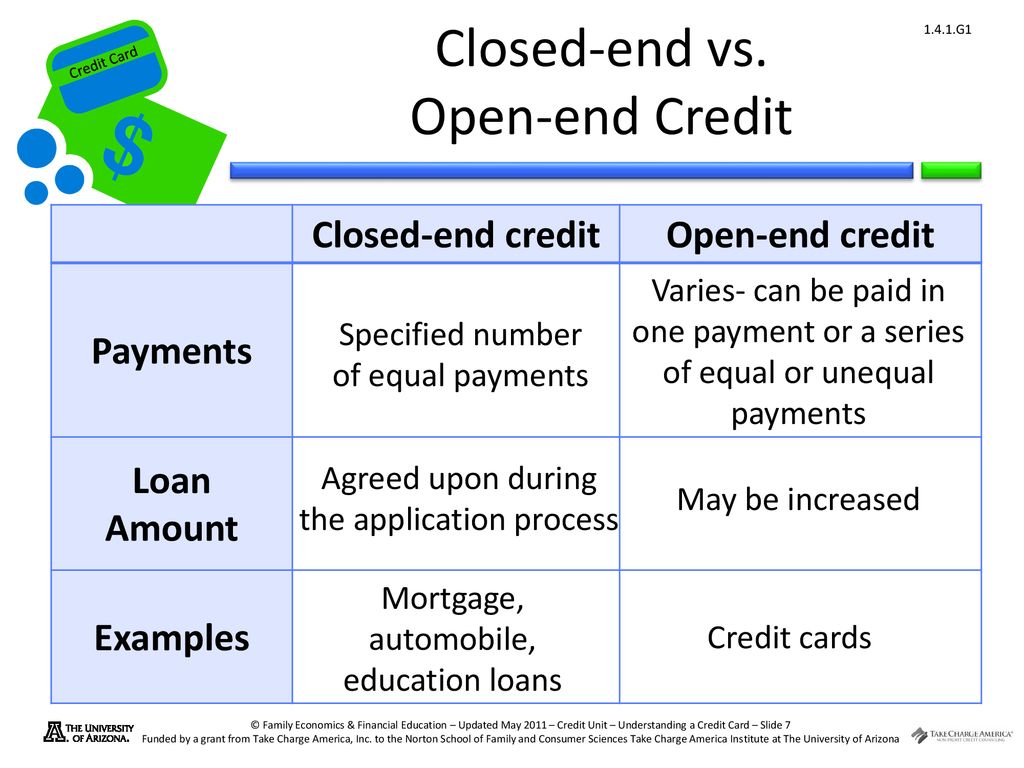

Open-end loans such as credit cards differ from closed-end loans such as vehicle loans in terms of how money are transferred and whether a consumer who has begun to pay. With closed end credit you cannot add to what you have borrowed.

Understanding A Credit Card Ppt Video Online Download

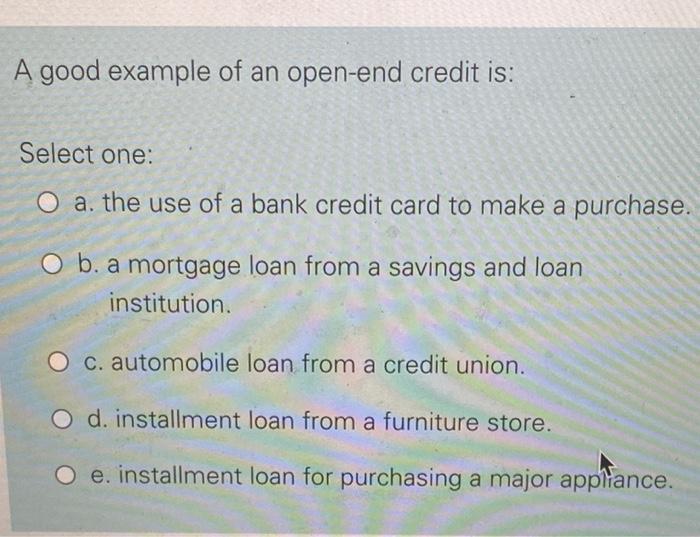

Having access to funds as soon as a payment is made on a credit card allows more flexibility.

. Its a type of loan with a fixed amount of funds that you generally use. September 27 2022. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the.

Personal loans are best for larger. Credit card accounts will show closed with no balance rather than paid in full so that there is no confusion about whether the account is open. Auto loans and boat loans are common examples of closed-end loans.

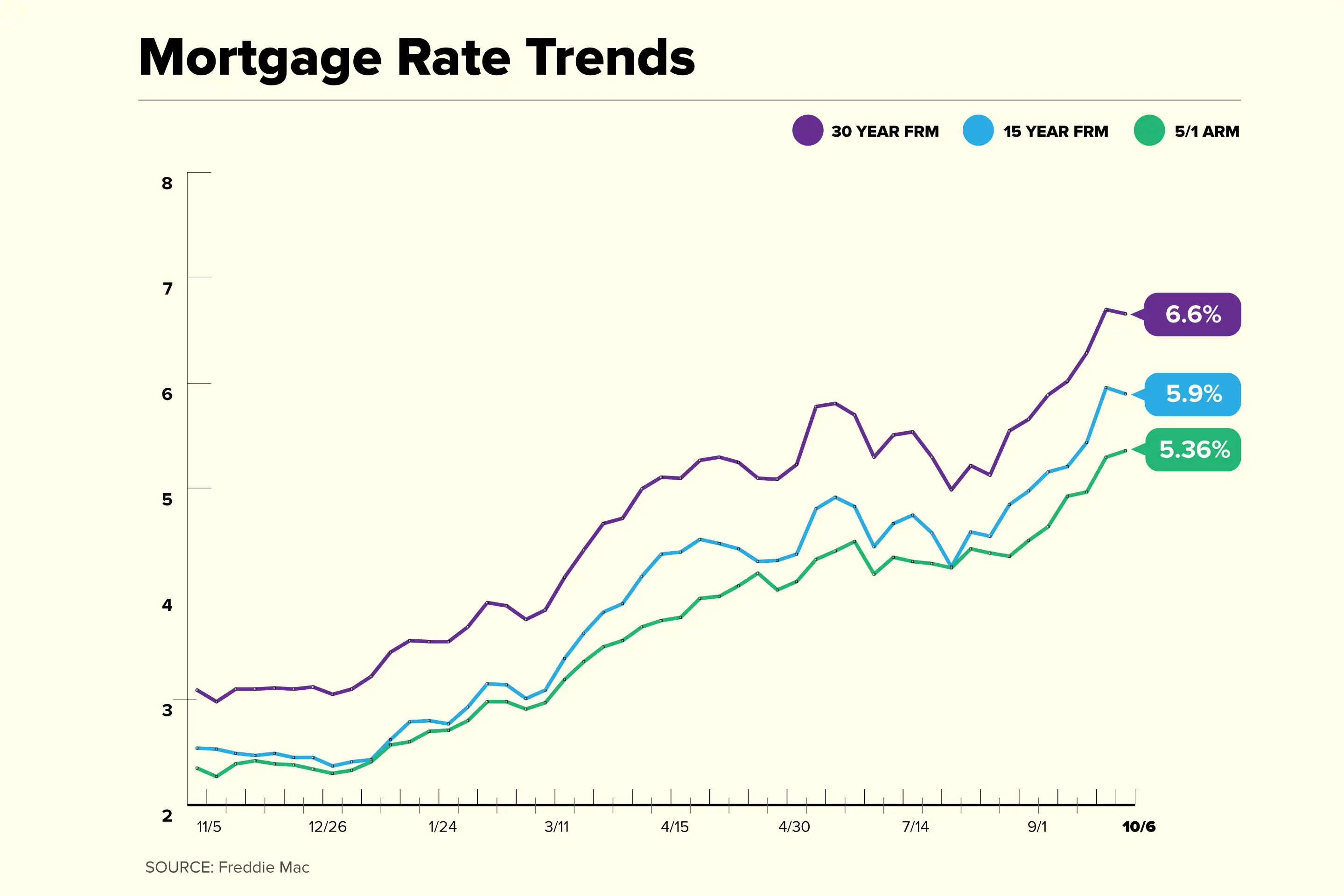

Closed-end credit loans are loans that offer a fixed amount of money to be paid back with interest and fees in an agreed-upon time frame. Closed-end credit is a type of loan where the borrower receives a large lump sum upfront and agrees to pay back the full balance over a specific period of time like a mortgage. Interest on closed-end credit loans offer a.

An open credit can take the form of a loan or credit card. Credit Cards Loans. The borrower can reuse.

As a result credit cards are the most popular form of open. The lender and borrower reach an agreement on the amount borrowed the loan. Personal Loans Up to 50000.

Open end loan can be borrowed multiple. Open-end credit is a revolving credit product while closed-end. With open-end or revolving credit loans are made on a continuous basis as you.

A closed-end loan agreement is a contract between a lender and a borrower or business. You must make payments on the loan until the interest and principal are paid off. Credit card accounts show closed.

Financial institutions can offer open-end credit and closed-end credit to consumers and businesses. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. Closed end credit is offered by financial institutions often referred to it as an installment loan or a secured loan.

A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. For example a car company will have a lien on the car until the car loan is paid in full. If you have a mortgage or a car loan you have closed-end credit.

A closed-end line of credit is a special type of financing facility that combines the benefits of revolving credit and also comes with a predetermined maturity date.

What Is The Difference Between A Line Of Credit And A Credit Card Quora

What Is A Good Apr For A Credit Card Rates By Score

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

Difference Between Open End Credit And Closed End Credit

Difference Between Open End Credit And Closed End Credit

Credit Card Vs Heloc First Nebraska Credit Union

When Were Credit Cards Invented The History Of Credit Cards Forbes Advisor

Open End Funds Vs Closed End Funds Smartasset

Debt Relief Understand Your Options And The Consequences Nerdwallet

Credit Card Vs Personal Loan Which Should You Use

Credit Basics Open Vs Closed Ended Credit Open Ended Credit Is Ongoing You Borrow You Repay You Borrow Again As Long As You Do Not Exceed Your Credit Ppt Download

Revolving Credit Vs Line Of Credit What S The Difference

Paying Off Your Loans Early What You Need To Know

Understanding A Credit Card Ppt Download

Open End Credit Vs Closed End Credit Lantern By Sofi

What Is Closed End Credit Experian

Credit Card Understanding Your Credit Card Credit Unit Take Charge Of Your Finances Ppt Download

The Difference Between Installment And Revolving Accounts Transunion

Solved A Good Example Of An Open End Credit Is Select One Chegg Com